A Financial Wellness Plan Can Help Pave the Road to Retirement

If we've learned any lesson over the past year, it's that no matter how carefully we plan and prepare, we'll likely encounter unexpected hurdles.

While a global pandemic has certainly underscored the need to pay close attention to our physical wellness, it has also revealed the need to shore up our financial wellness.

According to PwC's 9th Annual Financial Wellness Survey conducted in January 2020, financial matters were the top cause of stress for employees even well before the pandemic hit in earnest. More than one-third of full-time employed millennials, Gen Xers, and baby boomers had less than $1,000 in emergency savings. Only 29% of women said they would be able to cover their basic necessities if they found themselves out of work for an extended period, compared with 55% of men. And more than half of millennials and Gen Xers and 35% of baby boomers said they would likely use their retirement funds for something other than retirement, with most noting it would be for an unexpected expense or medical bills.(1)

Although tapping your retirement savings can help you get through a crisis, it can hinder your ability to afford a comfortable retirement. Having a plan to guard your financial wellness throughout your working years can help you avoid putting your retirement at risk.

What Is Financial Wellness?

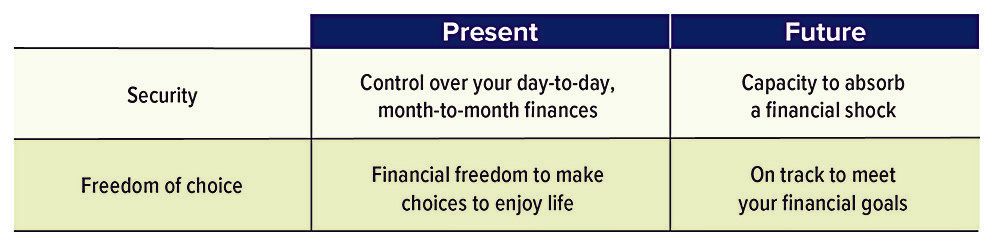

The Consumer Financial Protection Bureau (CFPB) defines financial well-being as:(2)

1. Having control over day-to-day and month-to-month finances.

In order to achieve this, your expenses need to be lower than your income.

2. MaintainIng the capacity to absorb a financial shock.

This typically refers to having adequate emergency savings and insurance.

3. Being on track to meet financial goals.

Meaning you have either a formal or informal plan to meet your goals and you are actively pursuing them.

4. Having the financial freedom to make choices that allow you to enjoy life, such as a splurge vacation.

The CFPB has identified several key factors that contribute to an individual's ability to achieve financial well-being. Among them are: (1) having the skills needed to find, process, and use relevant financial information when it's needed; and (2) exhibiting day-to-day financial behaviors and saving habits.

Assistance Is Available

Many employers have begun offering financial wellness benefits over the past decade. These programs have evolved from a focus on basic retirement readiness to those addressing broader financial challenges as health-care costs, general finance and budgeting, and credit/debt management.(3)

If you have access to work-based financial wellness benefits, be sure to take time and explore all that is offered. The education and services can provide valuable information and help you build the skills to make sound decisions in challenging circumstances.

In addition, a financial professional can become a trusted coach throughout your life. A qualified financial professional can provide an objective third-party view during tough times, while helping you anticipate and manage challenges and risks and, most important, stay on course toward a comfortable retirement.

(1) PwC, May 2020

(2) Consumer Financial Protection Bureau, January 2015

(3) Employee Benefit Research Institute, October 2020

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.