Accounts for Two: A Team Approach to Retirement Savings

Almost half of U.S. families headed by a married couple include two working spouses.1

With dual careers, many spouses accumulate assets in separate retirement accounts. Each might have funds in an employer-sponsored plan and an IRA.

Even if most of a married couple's retirement assets reside in different accounts, open communication and teamwork can help them craft a unified retirement strategy.

Working together

Tax-deferred retirement accounts such as 401(k)s, 403(b)s, and IRAs can be held in only one person's name. [A spouse is required to be the beneficiary of a 401(k), and to some extent, a 403(b), unless the spouse signs a written waiver.] Taxable investment accounts, on the other hand, may be held jointly.

Owning and managing separate portfolios allows each spouse to choose investments based on his or her individual risk tolerance. Some couples may prefer to maintain a high level of independence for this reason, especially if one spouse is more comfortable with market volatility than the other.

However, sharing plan information and coordinating investments could help some couples build more wealth over time. For example, one spouse's workplace plan may offer a broader selection of investment options, while the offerings in the other's plan might be somewhat limited. One employer may offer a better contribution match than the other.

Spouses who use a joint strategy might agree on an appropriate asset allocation for their combined savings and invest their contributions in a way that takes advantage of each plan's strengths while minimizing any weaknesses. (Asset allocation is a method to help manage investment risk; it does not guarantee a profit or protect against loss.)

In 2025, the maximum employee contribution to a 401(k) or 403(b) plan is $23,500 (plus an extra $7,500 for those age 50 and older or an extra $11,250 for those age 60 to 63). Employers often match contributions up to a set percentage of salary.

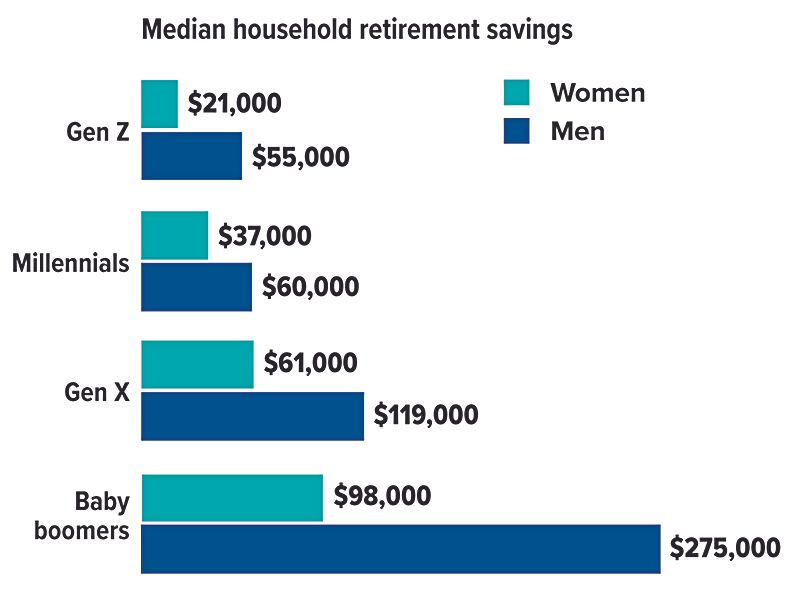

Lagging Balances

Despite solid saving habits, women report lower household retirement savings than men across all age groups. This is due primarily to lower wages, more women working part-time without benefits, and more women taking time off to care for children and other family members.

Spousal IRA opportunity

While many married couples have two wage earners, some spouses stay home to take care of children or other family members, or just to take a break from the workforce. And it's not unusual for one spouse to retire while the other continues to work. In any of these situations, it can be difficult to keep retirement savings on track.

Fortunately, a couple can contribute $7,000 to the working spouse's IRA and an additional $7,000 to the nonworking spouse's IRA (in 2024 and 2025), as long as their combined income exceeds both contributions and they file a joint tax return. An additional $1,000 catch-up contribution can be made for each spouse who is age 50 or older. All other IRA eligibility rules must be met.

Contributing to a spousal IRA may not only help a couple with a nonworking spouse save more towards retirement, it might also offer a potentially valuable tax deduction. That's because the IRS imposes higher income limitations for deductible contributions to spousal IRAs than for contributions made to the IRA of an active participant in an employer plan.

For married couples filing jointly, the ability to deduct contributions to the IRA of an active participant in a work-based plan is phased out at a modified adjusted gross income (MAGI) between $123,000 and $143,000 in 2024 ($126,000 and $146,000 in 2025). When the contribution is made to the IRA of a nonparticipating spouse, the phaseout limits are higher: MAGI between $230,000 and $240,000 in 2024 ($236,000 and $246,000 in 2025).

IRA contributions for the 2024 tax year can be made up to the April 15, 2025, tax filing deadline (May 1, 2025, for taxpayers affected by certain natural disasters).

Withdrawals from tax-deferred retirement plans are taxed as ordinary income and may be subject to a 10% federal tax penalty if withdrawn prior to age 59½, with certain exceptions as outlined by the IRS.

(1) U.S. Bureau of Labor Statistics, 2024 (2023 data)

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

All Rights Reserved | Thornapple Financial Center