Beware of These Life Insurance Beneficiary Mistakes

Life insurance has long been recognized as a useful way to provide for your heirs and loved ones when you die.

While naming your policy's beneficiaries should be a relatively simple task, there are a number of situations that can easily lead to unintended and adverse consequences. Here are several life insurance beneficiary traps you may want to discuss with a professional.

Creating a taxable situation

Generally, life insurance death proceeds are not taxed when they're paid. However, there are exceptions to this rule, and the most common situation involves having three different people as policy owner, insured, and beneficiary. Typically, the policy owner and the insured are one and the same person. But sometimes the owner is not the insured or the beneficiary. For example, mom may be the policy owner on the life of dad for the benefit of their children. In this situation, mom is effectively creating a gift of the insurance proceeds for her children/beneficiaries. As the donor, mom may be subject to gift tax. Consult a financial or tax professional to figure out the best way to structure the policy.

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased.

While trusts offer numerous advantages, they incur up-front costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your legal and tax advisors before implementing such strategies.

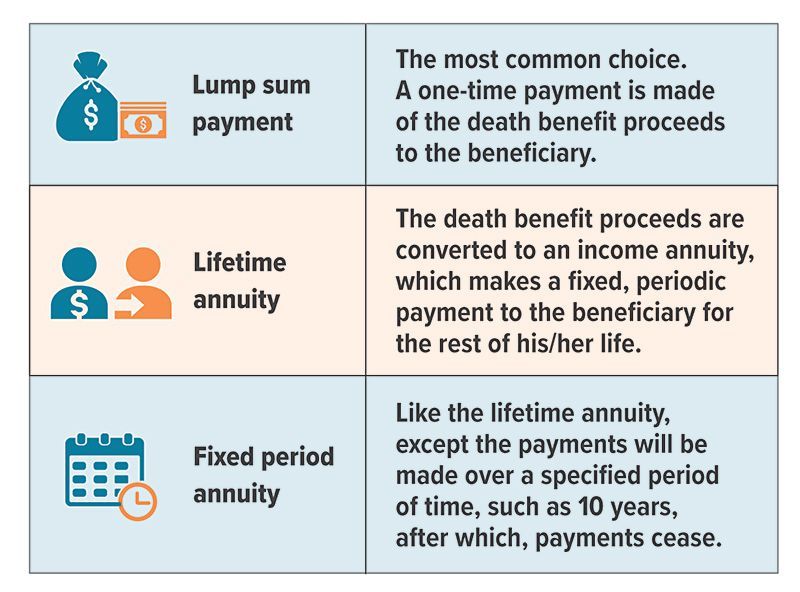

Life Insurance Payout Options

Most life insurance policies offer several options to the policy beneficiary, including:

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

All Rights Reserved | Thornapple Financial Center