Due Date Approaches for 2023 Federal Income Tax Returns

Tax filing season is here again. If you haven't done so already, you'll want to start pulling things together — that includes getting your hands on a copy of your 2022 tax return and gathering W-2s, 1099s, and deduction records.

You'll need these records whether you're preparing your own return or paying someone else to prepare your tax return for you.

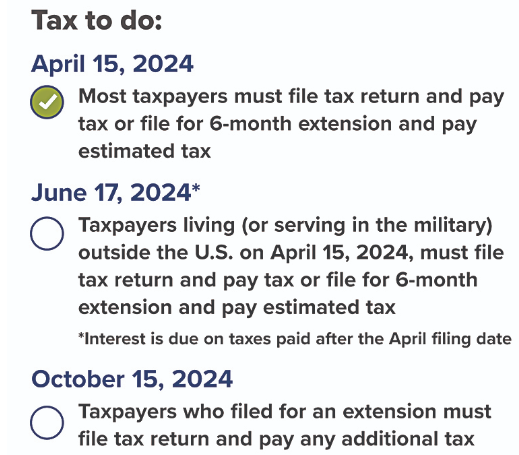

Don't procrastinate. The filing deadline for individuals is generally Monday, April 15, 2024.

Filing for an extension

If you don't think you're going to be able to file your federal income tax return by the due date, you can file for and obtain an extension using IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Filing this extension gives you an additional six months (to October 15, 2024) to file your federal income tax return. You can also file for an extension electronically — instructions on how to do so can be found in the Form 4868 instructions.

Filing for an automatic extension does not provide any additional time to pay your tax. When you file for an extension, you have to estimate the amount of tax you will owe and pay this amount by the April filing due date. If you don't pay the amount you've estimated, you may owe interest and penalties. In fact, if the IRS believes that your estimate was not reasonable, it may void your extension.

Note: Special rules apply if you're living outside the country or serving in the military and on duty outside the United States. In these circumstances, you are generally allowed an automatic two-month extension (to June 17, 2024) without filing Form 4868, though interest will be owed on any taxes due that are paid after the April filing due date. If you served in a combat zone or qualified hazardous duty area, you may be eligible for a longer extension of time to file.

What if you owe?

One of the biggest mistakes you can make is not filing your return because you owe money. If your return shows a balance due, file and pay the amount due in full by the due date if possible.

If there's no way that you can pay what you owe, file the return and pay as much as you can afford. You'll owe interest and possibly penalties on the unpaid tax, but you'll limit the penalties assessed by filing your return on time, and you may be able to work with the IRS to pay the remaining balance (options can include paying the unpaid balance in installments).

Expecting a refund?

The IRS has stepped up efforts to combat identity theft and tax refund fraud. More aggressive filters that are intended to curtail fraudulent refunds may inadvertently delay some legitimate refund requests. In fact, the IRS is required to hold refunds on all tax returns claiming the earned income tax credit or the additional child tax credit until at least February 15.

Most filers, though, can expect a refund check to be issued within 21 days of the IRS receiving a tax return. However, note that in recent years the IRS has experienced delays in processing paper tax returns.

So if you are expecting a refund on your 2023 tax return, consider filing as soon as possible and filing electronically.

Due Dates for 2023 Tax Returns

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

All Rights Reserved | Thornapple Financial Center