Different Inflation Measures, Different Purposes

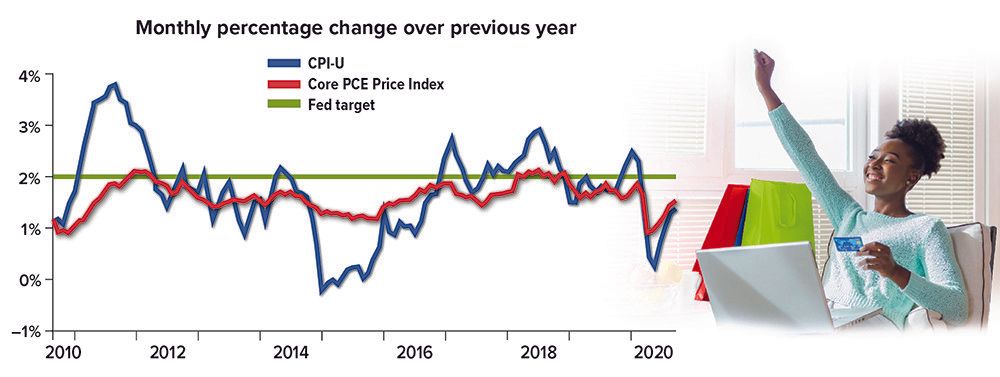

The inflation measure most often mentioned in the media is the Consumer Price Index for All Urban Consumers (CPI-U), which tracks the average change in prices paid by consumers over time for a fixed basket of goods and services. In setting economic policy, however, the Federal Reserve Open Market Committee focuses on a different measure of inflation — the Personal Consumption Expenditures (PCE) Price Index, which is based on a broader range of expenditures and reflects changes in consumer choices. More specifically, the Fed focuses on "core PCE," which strips out volatile food and energy categories that are less likely to respond to monetary policy. Over the last 10 years, core PCE prices have generally run below the Fed's 2% inflation target.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.