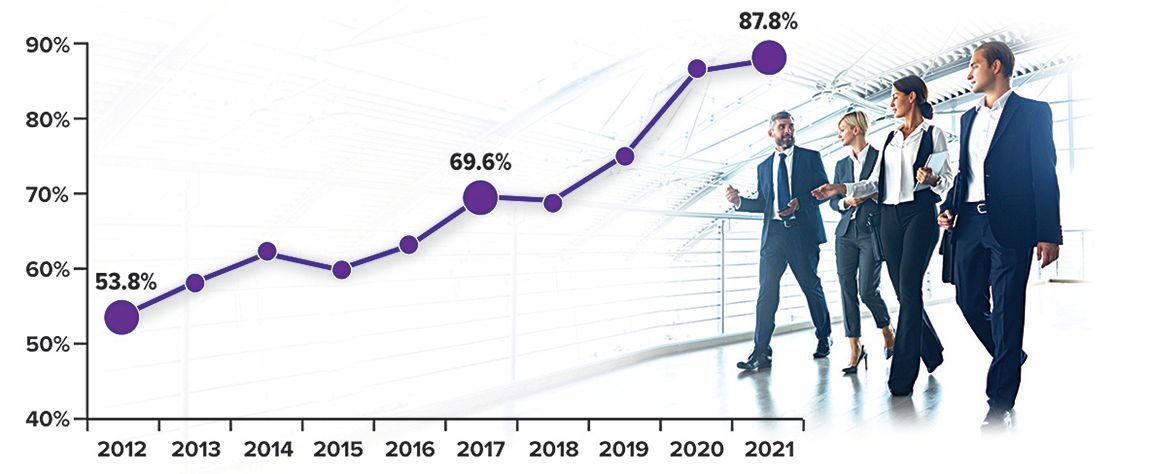

Employee Access to Roth 401(k) Plans on the Rise

Roth 401(k) plans can offer an ideal opportunity to build a source of tax-free retirement income. There are no income restrictions to participate, they have much higher contribution limits than Roth IRAs, and they may offer employer matching contributions. And thanks to the SECURE 2.0 Act of 2022, beginning in 2024, Roth 401(k)s will no longer impose required minimum distributions in retirement. The percentage of employers offering a Roth 401(k) plan grew substantially from 2012 to 2021, a trend that may continue.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.