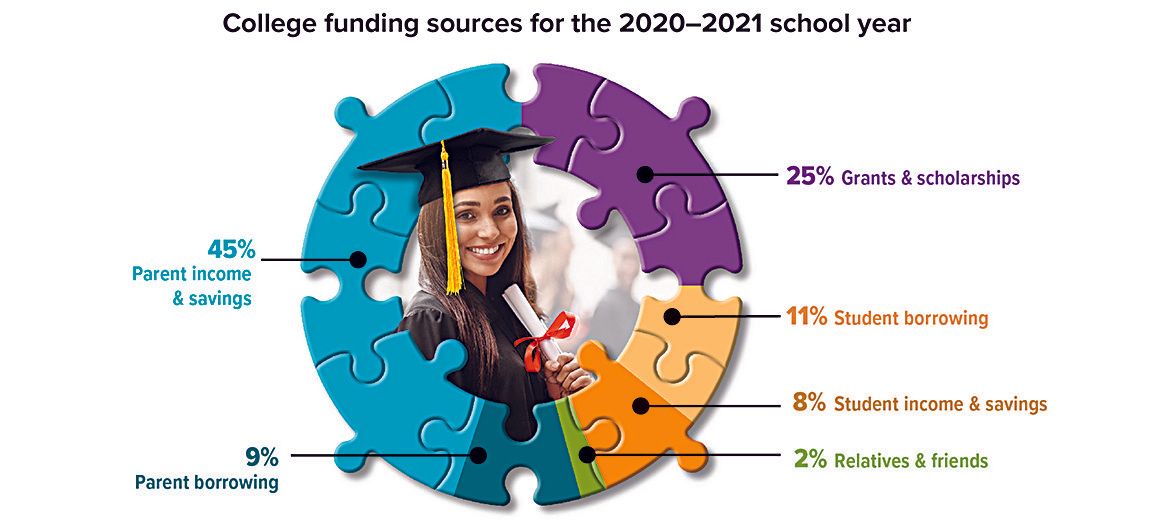

Paying for College: Pieces of the Funding Puzzle

The typical family uses a combination of income, savings, borrowing, and grants/scholarships to pay for college. Not surprisingly, the largest source of funding — 45% — comes from parents in the form of current income and savings.

Starting a college fund as early as possible and aggressively looking for grant aid at college time can help families reduce the amount they may need to borrow, giving students greater flexibility when making decisions. Colleges are usually the best source of grant aid. A net price calculator (available on every college website) can help students estimate how much grant aid they might receive at specific colleges.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.