Reasons to Roll

When you leave your job or retire, you have an opportunity to manage your funds in an employer-sponsored retirement plan such as a 401(k), 403(b), or government 457(b) plan. Depending on the situation, you generally have four options.* The approach that typically gives you the most control over the funds is to transfer some or all of the assets to an IRA through a rollover.

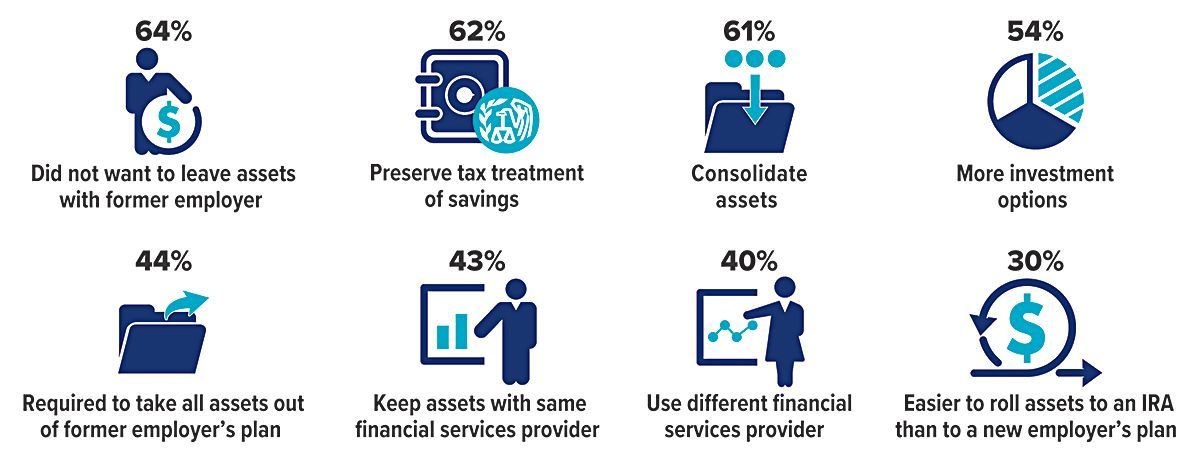

Three out of five households who owned traditional IRAs in 2022 had executed at least one IRA rollover from an employer-sponsored retirement plan. These were the top reasons for the most recent rollover.

*Other options may include leaving assets in the former employer's plan, transferring assets to a new employer-sponsored plan, or withdrawing the money.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

All Rights Reserved | Thornapple Financial Center