Return of Premium Life Insurance: Protection and Cash Back

HOW ROP COMPARES TO STRAIGHT TERM INSURANCE

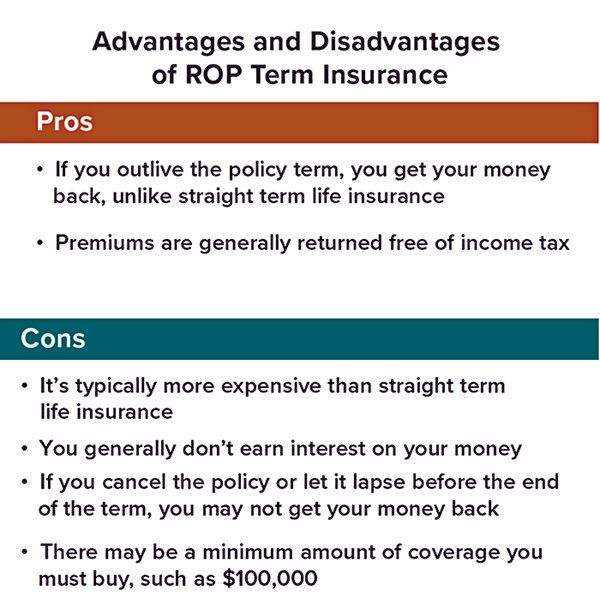

In general, straight term insurance provides life insurance coverage for a specific number of years, called the term. The face amount of the policy, or death benefit, is paid to your beneficiaries if you die during the term. If you live longer than the term, or you cancel your policy during the term, nothing is paid. By contrast, an ROP term life insurance policy returns some or all of the premiums you paid if you live past the term of your policy and haven't cancelled coverage. Some issuers may even pay back a pro-rated portion of your premium if you cancel the ROP policy before the end of the term. Also, the premium returned generally is not considered ordinary income, so you won't have to pay income taxes on the money you receive from the insurance company. (Please consult your tax professional.)

A return of premium feature may be appealing if you want to have a return of some or all of your premium if you outlive the policy term. Yet the cost of ROP insurance can be significantly higher than straight term insurance, depending on the issuer, age of the insured, the amount of coverage (death benefit), and length of the term. But ROP almost always costs less than permanent life insurance with the same death benefit. While straight term insurance can be purchased for terms as short as one year, most ROP insurance is sold for terms of 10 years or longer.

ROP CONSIDERATIONS

It's great to know you can get your money back if you outlive the term of your life insurance coverage, but there is a cost for that benefit. Also, if you die during the term of insurance coverage, your beneficiaries will receive the same death benefit from the ROP policy as they would from the less-expensive straight term policy.

When choosing between straight term and ROP term, you might think about the amount of coverage you need, the amount of money you can afford to spend, and the length of time you need the coverage to continue. Your insurance professional can help you by providing information on straight term and ROP term life insurance, including their respective premium costs.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that you are insurable. Optional riders are available for an additional fee and are subject to contractual terms, conditions and limitations as outlined in the prospectus and may not benefit all investors. Any guarantees associated with payment of death benefits, income options, or rates of return are based on the claims paying ability and financial strength of the insurer.

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

All Rights Reserved | Thornapple Financial Center