Saving for Retirement Health-Care Costs

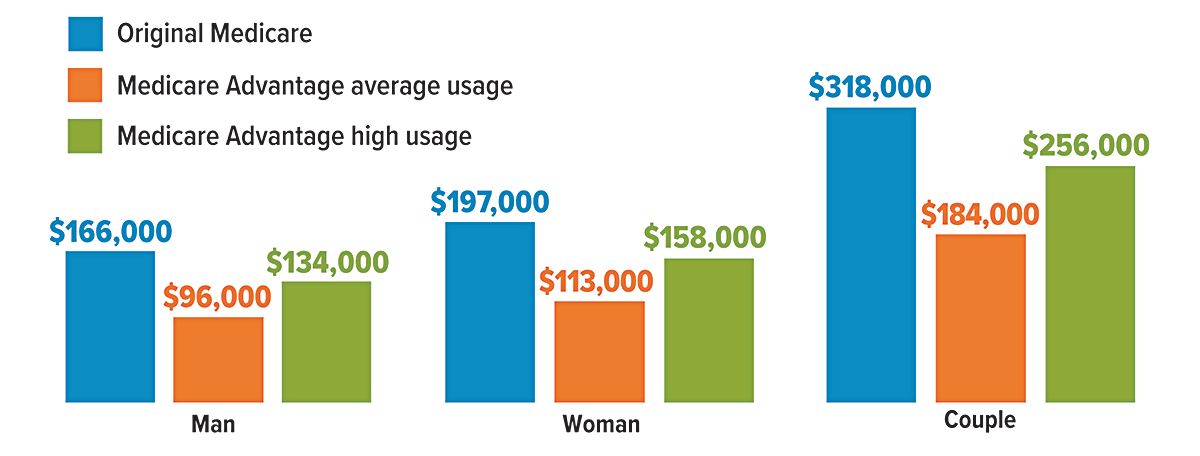

The chart below shows the savings that a man, a woman, and a couple who retired at age 65 in 2022 might need to meet retirement health-care expenses, assuming median prescription drug expenses. The Original Medicare estimate includes premiums for Medicare Parts B and D, the Part B deductible, out-of-pocket prescription drug spending, and premiums for Medigap Plan G, which would pay most other out-of-pocket costs.

Medicare Advantage Plans — offered by private companies under Medicare oversight — require the Medicare Part B premium and typically combine hospital, medical, and prescription drug coverage. They often have limited networks and may require approval to cover certain medications and services.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

All Rights Reserved | Thornapple Financial Center