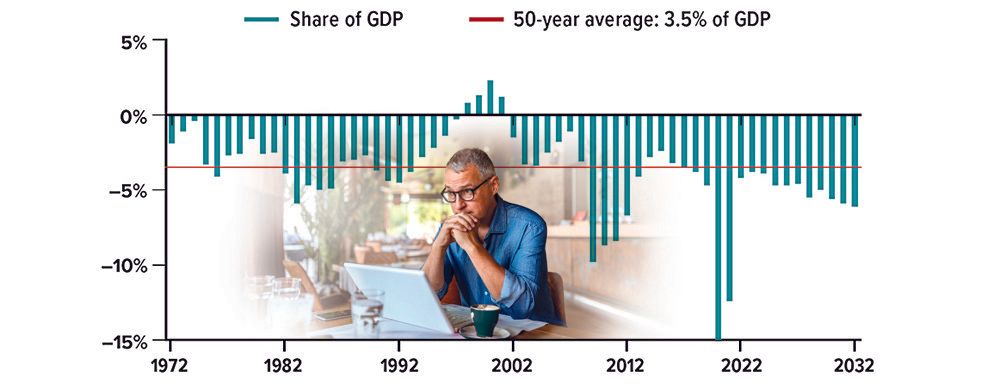

U.S. Deficit Lower for Now

After record federal budget deficits of $3.1 trillion in 2020 and $2.8 trillion in 2021, the 2022 deficit is projected to drop to $1.0 trillion, due to increased tax revenue from a stronger economy and the end of government pandemic-relief spending. These deficits are equivalent to 15.0%, 12.4%, and 4.2% of gross domestic product (GDP), respectively. For comparison, the deficit averaged 3.5% of GDP over the last 50 years.

The deficit is expected to drop further in 2023 before rising steadily due to increasing health-care costs for an aging population and higher interest rates on mounting government debt. In 2032, the deficit is projected to be almost $2.3 trillion, equivalent to 6.1% of GDP.

All Securities Through Money Concepts Capital Corp., Member FINRA / SIPC

11440 North Jog Road, Palm Beach Gardens, FL 33418 Phone: 561.472.2000

Copyright 2010 Money Concepts International Inc.

Investments are not FDIC or NCUA Insured

May Lose Value - No Bank or Credit Union Guarantee

This communication is strictly intended for individuals residing in the state(s) of MI. No offers may be made or accepted from any resident outside the specific states referenced.

Prepared by Broadridge Advisor Solutions Copyright 2020.

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

Contact Info

Address:

9426 Spring Creek Ct

Middleville, MI 49333

Phone:

Fax :

269.795.3420

Hours:

January

Mon - Fri 9am - 5pm

Sat & Sun Closed

February - April 15 (Tax Season)

Mon - Fri 9am - 6pm

Sat 9am - 1pm

Sun Closed

April 16 - December 31

Tue - Thur 9am - 5pm

Other times by appointment

All Rights Reserved | Thornapple Financial Center